Are you ready to unlock the secrets of successful trading on Binomo? Whether you’re a seasoned trader or just starting your journey in the world of online investing, mastering the art of strategy is crucial for maximizing your profits. In this blog post, we’re diving deep into the realm of Binomo strategies, exposing five powerful secrets that can elevate your trading game and enhance your earning potential.

From understanding market trends to harnessing the power of technical analysis, we’ll explore proven strategies that can help you make informed decisions and minimize risks. You’ll learn how to effectively manage your capital, utilize psychological tactics to stay disciplined, and choose the right assets to trade. By the end of this post, you’ll be equipped with practical insights and actionable tips that can transform your trading experience on Binomo. So, let’s get started and uncover the keys to success that can lead you on the path to financial freedom!

Table of contents

Introduction

Binomo as a Trading Platform

In the ever-evolving landscape of online trading, Binomo has emerged as a notable platform that caters to both novice and experienced traders. Launched in 2014, Binomo has quickly gained recognition for its user-friendly interface and extensive range of trading options. Whether you are interested in currency pairs, commodities, or stocks, this platform offers a diverse array of assets to trade, making it an appealing choice for many.

One of the key features of Binomo is its commitment to providing a seamless trading experience. The platform is designed with simplicity in mind, allowing users to navigate effortlessly through its various functionalities. This is particularly beneficial for beginners who may feel overwhelmed by more complex trading platforms. The availability of a demo account allows new traders to practice and hone their skills without the risk of losing real money, thus fostering a supportive environment for learning.

Binomo is also known for its competitive trading conditions. It offers a minimum deposit requirement that is accessible for most users, along with a range of account types tailored to different trading styles and experience levels. Traders can access a wealth of educational resources, including webinars, tutorials, and market analyses, which can significantly enhance their trading knowledge and strategies.

Security and regulation are paramount in the trading world, and Binomo takes these concerns seriously. The platform operates under the regulations of the International Financial Commission, which adds a layer of credibility and trust for its users. This ensures that traders can engage in their activities with confidence, knowing that their funds and personal information are well protected.

In summary, Binomo stands out as a robust trading platform that combines accessibility, educational resources, and a secure trading environment. Whether you are just starting your trading journey or looking to expand your portfolio, Binomo offers the tools and support necessary to navigate the dynamic world of online trading successfully.

Section 1: Understanding Binomo

Overview of Binomo

Binomo is an online trading platform that has gained popularity for its user-friendly interface and diverse trading options. Established in 2014, Binomo caters to both novice and experienced traders, offering a range of financial instruments including currencies, commodities, stocks, and indices. The platform operates under the regulations of the International Financial Commission (IFC), ensuring a level of credibility and security for its users.

At its core, Binomo is an online trading platform that specializes in binary options trading. This means that traders speculate on the price movement of various assets, predicting whether the price will rise or fall within a specific timeframe. If a trader’s prediction is correct, they can earn a substantial return on their investment—often up to 90% in some cases. However, if the prediction is incorrect, they may lose their initial investment.

One of the standout features of Binomo is its demo account option, which allows new users to practice trading without any financial risk. This is an excellent way for beginners to familiarize themselves with the platform’s functionalities, trading strategies, and market dynamics. The demo account is funded with virtual money, enabling users to gain hands-on experience before committing real funds.

The platform also offers various trading tools and resources to help users make informed decisions. Traders can access educational materials, webinars, and market analysis to enhance their trading skills and strategies. Additionally, Binomo provides multiple account types, catering to different levels of experience and capital investment. Each account type comes with its own set of features, including varying limits on deposits, withdrawals, and access to premium trading tools.

In terms of accessibility, Binomo is available as a web platform and also has mobile applications for both iOS and Android devices. This means that traders can engage in trading activities anytime and anywhere, making it a convenient option for those with a busy lifestyle.

Overall, Binomo stands out in the online trading landscape by combining simplicity with powerful trading tools, making it an attractive option for anyone looking to dive into the world of binary options trading. Whether you are a beginner eager to learn or an experienced trader seeking new opportunities, Binomo offers a robust platform to explore the financial markets.

Types of assets available for trading on Binomo

When it comes to trading platforms, the diversity of assets available can significantly influence a trader’s strategy and potential for profit. Binomo, as an emerging player in the online trading landscape, offers an array of assets that cater to both novice and experienced traders. Understanding the types of assets available on Binomo can help traders make informed decisions and optimize their trading experience.

1. Currency Pairs

One of the most popular asset classes on Binomo is currency pairs. The platform provides access to a wide variety of forex pairs, including major, minor, and exotic currencies. Major pairs like EUR/USD and GBP/USD are favored for their liquidity and volatility, making them ideal for day traders. Exotic pairs, which involve a major currency paired with a less commonly traded currency, can offer unique opportunities, albeit with higher risks due to lower liquidity.

2. Stocks

For those who prefer to trade equities, Binomo offers a selection of stocks from various global markets. Traders can speculate on the price movements of shares from renowned companies across diverse sectors, such as technology, finance, and healthcare. The ability to trade stocks enables users to leverage company performance, market trends, and economic indicators to inform their trading strategies.

3. Commodities

Commodities are another asset class available on Binomo, allowing traders to engage with physical goods like gold, oil, and agricultural products. Trading commodities often requires an understanding of global supply and demand dynamics, seasonal trends, and geopolitical influences. This asset class can provide diversification for traders looking to hedge against stock market volatility.

4. Indices

Binomo also offers trading opportunities on various stock market indices, which represent a collection of stocks that provide insight into market trends. Popular indices available for trading include the S&P 500, NASDAQ, and FTSE 100. Trading indices can be a strategic way to gain exposure to broader market movements without having to select individual stocks, making it a preferred choice for many investors.

5. Cryptocurrencies

In recent years, cryptocurrencies have surged in popularity, and Binomo has not been left behind. The platform allows trading in major cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Given the high volatility associated with crypto assets, traders on Binomo can capitalize on rapid price movements, though they should also be mindful of the associated risks.

Explanation of the trading mechanisms: options trading, fixed time trades, etc.

When it comes to trading in financial markets, understanding the various mechanisms available is essential for both novice and experienced traders. Among the popular platforms, Binomo stands out for its user-friendly interface and diverse trading options. In this section, we will delve into two prominent trading mechanisms available on Binomo: options trading and fixed time trades.

Options Trading

Options trading is a sophisticated financial instrument that allows traders to speculate on the future price movements of assets without actually owning the underlying asset. On Binomo, options trading involves the purchase of a contract that grants the trader the right, but not the obligation, to buy or sell an asset at a predetermined price (known as the strike price) before the contract expires.

Key characteristics of options trading on Binomo include:

- Flexibility: Traders can choose between various expiration times, ranging from minutes to hours, allowing for both short-term and long-term strategies.

- Leverage: Options can be leveraged, meaning that traders can control larger positions with a smaller amount of capital, amplifying potential returns (and risks).

- Diverse Assets: Binomo offers options trading on a variety of assets, including stocks, commodities, currencies, and indices, providing traders with a broad spectrum of opportunities.

When engaging in options trading, it’s crucial to conduct thorough market analysis. Traders typically employ technical analysis tools, such as charts and indicators, to make informed decisions on price movements.

Fixed Time Trades

Fixed time trades, also known as binary options, represent a simpler form of trading that is particularly appealing to beginners. This mechanism allows traders to predict whether the price of an asset will rise or fall within a specified time frame. The outcome is either a fixed return if the prediction is correct or a total loss of the invested amount if it is incorrect.

Here’s what you need to know about fixed time trades on Binomo Strategies:

- Simplicity: The straightforward nature of fixed time trades makes them accessible to traders at all levels. You simply choose an asset, predict the price movement, and set the expiration time.

- Defined Risk and Reward: Each trade has a predetermined payout structure, which means traders know exactly how much they stand to gain or lose before placing a trade.

- Time-Limited Decisions: With expiration times often ranging from 1 minute to 1 hour, traders must

- make quick, informed decisions, which can enhance their ability to react to market changes swiftly.

- Market Analysis: Although fixed time trades are simpler, effective market analysis remains critical. Traders often utilize tools such as candlestick charts, trend lines, and market news to gauge potential movements.

Section 2: The Importance of Trading Strategies

Definition of trading strategies and their role in successful trading

Trading Binomo strategies are essential frameworks that traders use to make informed decisions about buying and selling assets in the financial markets. At their core, these strategies are systematic approaches that outline when to enter or exit a trade, taking into account various market conditions, price movements, and economic indicators. For traders using platforms like Binomo, having a well-defined trading strategy can significantly enhance their chances of success.

What is a Trading Strategy?

A trading strategy is a set of rules and guidelines that dictate how a trader will operate in the market. This includes criteria for selecting trades, managing risk, and determining profit targets. Strategies can be based on technical analysis, fundamental analysis, or a combination of both. Some common types of trading strategies include:

- Day Trading: Involves making multiple trades within a single day, focusing on short-term price movements.

- Swing Trading: Aims to capture price moves over several days or weeks, relying on market trends and patterns.

- Scalping: A high-frequency trading strategy that involves making dozens or hundreds of trades in a single day, seeking small profits from minor price fluctuations.

- Trend Following: A strategy that attempts to capture gains by riding the momentum of an asset in a particular direction.

Each strategy has its own set of rules and indicators that traders utilize to make decisions, and the choice of strategy often depends on the trader’s risk tolerance, time commitment, and market knowledge.

The Role of Trading Strategies in Successful Trading

- Consistency and Discipline: A well-defined trading strategy helps traders maintain consistency in their trading activities. By adhering to a specific plan, traders can avoid emotional decision-making, which often leads to losses. For instance, if a trader using Binomo Strategies that specifies entry and exit points based on certain indicators, they are less likely to make impulsive trades based on market noise.

- Risk Management: Effective trading strategies incorporate risk management techniques that protect traders from significant losses. This can include setting stop-loss orders, determining optimal position sizes, and diversifying trades. By managing risk effectively, traders can preserve their capital and stay in the market longer, which is crucial for success.

- Performance Evaluation: A defined trading strategy allows traders to evaluate their performance objectively. By keeping track of trades according to the strategy, traders can analyze what works and what doesn’t, making it easier to refine their approach.

Common Pitfalls of Trading Without a Strategy

In the fast-paced world of trading, particularly on platforms like Binomo Strategies, the allure of quick profits can often lead traders to jump in without a well-defined strategy. While the excitement of trading can be thrilling, the absence of a structured approach can result in significant pitfalls that may jeopardize your financial health. Here are some common mistakes traders make when they venture into trading without a strategy:

1. Emotional Decision-Making

One of the most significant risks of trading without a strategy is the tendency to let emotions drive decisions. In the heat of the moment, traders may react impulsively to market movements—buying when prices are high out of fear of missing out (FOMO) or selling in a panic when faced with losses. This emotional rollercoaster can lead to a cycle of bad decisions, ultimately resulting in substantial financial losses.

2. Lack of Risk Management

Without a clear strategy, many traders neglect risk management principles. This can manifest as over-leveraging, where traders invest more than they can afford to lose, or failing to set stop-loss orders, leading to significant losses when the market moves against them. A well-thought-out trading strategy includes risk management guidelines that protect your capital and ensure long-term sustainability.

3. Inconsistent Trading Behavior

Trading without a strategy often leads to erratic and inconsistent trading behavior. Some days, traders may be aggressive, while on others, they may be overly cautious. This inconsistency not only affects trading performance but can also create a sense of confusion and frustration. A solid strategy provides a framework for making decisions, fostering discipline and consistency in trading actions.

4. Overtrading

In the absence of a trading plan, it’s easy to fall into the trap of overtrading. Traders may feel compelled to enter multiple trades in quick succession, hoping to catch every opportunity that arises. However, overtrading often leads to increased transaction costs, emotional fatigue, and a lack of focus on quality trades. A well-defined strategy helps traders identify the most promising opportunities and avoid unnecessary trades.

5. Ignoring Market Analysis

Traders who operate without a strategy often overlook the importance of market analysis. Technical and fundamental analyses are crucial for understanding market trends, price movements, and potential entry and exit points. By failing to incorporate these analyses into their trading approach, traders miss valuable insights that can guide their decisions and improve their chances of success.

Benefits of Having a Well-Defined Strategy in Trading with Binomo

In the fast-paced world of trading, having a well-defined strategy is not just advantageous; it’s essential for success. This holds particularly true for platforms like Binomo, where the dynamics of trading require traders to be both agile and informed. Here are some key benefits of implementing a solid trading strategy on Binomo:

1. Enhanced Decision-Making

A well-structured strategy acts as a roadmap for your trading activities. It provides clear guidelines on when to enter or exit a trade, helping you make decisions based on logic rather than emotions. With a defined strategy, traders can avoid impulsive trades driven by fear or greed, which are common pitfalls in the trading world.

2. Risk Management

One of the critical components of any successful trading strategy is effective risk management. By clearly outlining your risk tolerance and setting stop-loss and take-profit levels, you can protect your capital from unforeseen market swings. This is particularly important on platforms like Binomo, where volatility can significantly impact trades. A well-defined strategy helps you manage and mitigate risks effectively, ensuring you remain in the game longer.

3. Consistency in Results

Consistency is key in trading, and having a well-defined strategy fosters just that. By following a set plan, you can achieve more stable results over time. This consistency is essential for building confidence in your trading abilities and allows for better performance tracking. Binomo traders who adhere to a defined strategy are more likely to see positive outcomes as opposed to those who trade haphazardly.

4. Adaptability to Market Changes

While a strategy provides structure, it also allows for flexibility. As market conditions change, traders can adjust their strategies accordingly without losing sight of their overall goals. This adaptability is vital for success in a platform like Binomo, where market trends can shift rapidly. A well-defined strategy enables you to pivot and refine your approach as needed, keeping you aligned with the market’s pulse.

5. Building Discipline

Trading can be emotionally taxing, and discipline is often what separates successful traders from those who struggle. A well-defined strategy instills a sense of discipline, encouraging traders to stick to their plans rather than chase quick profits. This disciplined approach helps cultivate a professional mindset, which is crucial for long-term success in trading on Binomo.

Section 3: Key Binomo Strategies for Success

Subsection 3.1: Technical Analysis

Technical Analysis

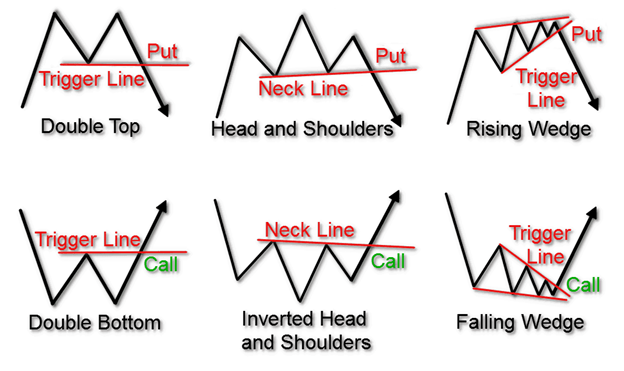

In the dynamic world of trading and investing, understanding market behavior is crucial for making informed decisions. One of the most widely used methods for analyzing market trends and predicting future price movements is technical analysis. Unlike fundamental analysis, which focuses on a company’s financial health and economic indicators, technical analysis emphasizes price movements and trading volumes. By examining historical price data, technical analysts aim to identify patterns and trends that can inform their trading strategies.

At its core, technical analysis operates on the premise that all information is reflected in the price of a security. Traders utilize various tools and techniques, such as charts and indicators, to assess market sentiment and momentum. One of the key principles behind technical analysis is the belief that prices move in trends—upward, downward, or sideways—and identifying these trends can provide valuable insights into potential future price action.

Technical analysis employs a range of charting techniques, including line charts, bar charts, and candlestick charts, each offering different perspectives on price movements. Candlestick charts, in particular, have gained popularity for their ability to convey information about market sentiment in a visually appealing format. Traders also rely on technical indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to help filter out market noise and make more informed trading decisions.

Another critical aspect of technical analysis is the concept of support and resistance levels. Support refers to a price level where a stock tends to stop falling and may even rebound, while resistance is a level where prices tend to stop rising and may reverse downward. Understanding these levels can provide traders with entry and exit points, maximizing their potential for profit while managing risk.

As you delve deeper into the world of technical analysis, it’s essential to remember that no method is foolproof. While technical analysis can enhance your trading strategy, it should be used in conjunction with other analytical approaches and risk management techniques. By combining insights from technical analysis with market fundamentals and your own trading plan, you can better position yourself for success in the ever-changing landscape of financial markets.

In summary, technical analysis is a powerful tool that can help traders make sense of market movements and improve their trading outcomes. Whether you are a novice trader or an experienced investor, understanding the principles of technical analysis can provide you with a solid foundation for navigating the complexities of the financial markets.

Key Tools and Indicators in Technical Analysis: Moving Averages, RSI, and Bollinger Bands

In the realm of technical analysis, traders and investors rely on a variety of tools and indicators to make informed decisions about market movements. Among these, moving averages, the Relative Strength Index (RSI), and Bollinger Bands stand out as essential instruments for analyzing price trends and potential reversals. Understanding how to effectively use these tools can significantly enhance your trading strategy.

Moving Averages

Moving averages smooth out price data to create a trend-following indicator that helps traders identify the direction of the trend. There are two primary types: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

- Simple Moving Average (SMA) calculates the average price over a specified number of periods. For instance, a 50-day SMA takes the average closing prices of the last 50 days. This tool is particularly useful for identifying support and resistance levels and recognizing market trends over a longer duration.

- Exponential Moving Average (EMA) gives more weight to recent prices, making it more responsive to new information. This characteristic allows traders to capture trends more quickly, making the EMA a favorite for shorter-term trading strategies.

Traders often use moving averages in conjunction with each other (like the 50-day and 200-day moving averages) to identify crossover points that signal potential buy or sell opportunities.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market.

- An RSI above 70 usually indicates that an asset is overbought, suggesting that a price correction may be on the horizon. Conversely, an RSI below 30 indicates oversold conditions, which can signal a potential upward reversal.

Traders often use the RSI in conjunction with other indicators to confirm trends or reversals. For instance, if an asset is approaching a resistance level while the RSI shows overbought conditions, this could reinforce the likelihood of a price pullback.

Bollinger Bands

Developed by John Bollinger, Bollinger Bands consist of a middle band (the SMA) and two outer bands that are standard deviations away from this middle band. This setup helps traders visualize volatility and potential price levels.

- The width of the bands varies with market volatility: narrower bands indicate low

- volatility, while wider bands suggest high volatility. Traders often interpret the position of the price relative to the bands to make trading decisions.

- When the price touches the upper band, it may indicate that the asset is overbought, potentially signaling a reversal or pullback. On the other hand, when the price reaches the lower band, it can suggest that the asset is oversold, hinting at a possible upward movement.

- Bollinger Bands can also be used to identify potential breakouts. When the bands contract, it often precedes a significant price move, whether upward or downward. Traders keep a close eye on these contractions, as they can indicate increased volatility and the possibility of a trend change.

- Conclusion

- Incorporating moving averages, RSI, and Bollinger Bands into your trading toolkit can provide valuable insights into market behavior and price action. While each of these indicators has its strengths and limitations, using them together can enhance your analysis and decision-making process.

- By understanding and applying these key tools, traders can better navigate the complexities of the market, identify potential entry and exit points, and ultimately improve their chances of success. Whether you’re a seasoned trader or just starting, mastering these indicators can help you develop a more disciplined and strategic approach to trading.

Subsection 3.2: Fundamental Analysis

Fundamental Analysis

Fundamental analysis is a cornerstone of investment strategy, serving as a vital tool for investors seeking to evaluate the intrinsic value of a security. At its core, fundamental analysis involves the examination of various economic, financial, and other qualitative and quantitative factors that can influence the performance of a company or asset. This method contrasts with technical analysis, which focuses primarily on price movements and trading volumes.

What is Fundamental Analysis?

Fundamental analysis aims to determine the true value of a stock or other securities by assessing the underlying factors that drive its performance. Investors who utilize this approach conduct a thorough investigation of a company’s financial statements, management team, industry conditions, and overall economic environment. By analyzing these components, they can make informed decisions about whether a security is undervalued or overvalued compared to its market price.

Key Components of Fundamental Analysis :

- Financial Statements: The foundation of fundamental analysis lies in scrutinizing a company’s financial statements, including the income statement, balance sheet, and cash flow statement. These documents provide insights into revenue, expenses, profit margins, assets, liabilities, and cash generation capabilities. Key ratios derived from these statements, such as the price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio, help investors assess a company’s financial health.

- Economic Indicators: Broader economic factors also play a significant role in fundamental analysis. Investors monitor indicators such as GDP growth rates, unemployment rates, inflation, and interest rates to gauge the overall economic environment. A robust economy typically leads to higher consumer spending and business investment, positively impacting company performance.

- Industry Analysis: Understanding the industry in which a company operates is crucial for fundamental analysis. Factors such as market trends, competitive landscape, regulatory environment, and technological advancements can greatly influence a company’s potential for growth and profitability. Analysts often use Porter’s Five Forces framework to evaluate industry dynamics and competitive pressures.

- Management Evaluation: The effectiveness of a company’s management team is another critical aspect of fundamental analysis. Investors assess the leadership’s track record, strategic vision, and operational efficiency. Strong management can steer a company through challenges and capitalize on opportunities, significantly impacting its long-term success.

- Qualitative Factors: Beyond numbers, qualitative factors such as brand strength, customer loyalty, and market positioning also inform fundamental analysis. A company with a strong brand reputation and loyal customer base is often

- better positioned to withstand market fluctuations and competitive pressures. These intangible assets can be pivotal in assessing a company’s long-term viability and growth potential.

- The Process of Conducting Fundamental Analysis

- The process of fundamental analysis typically involves several steps:

- Identify the Security: Investors begin by selecting the stock or asset they wish to analyze. This could be based on personal interest, market trends, or recommendations from analysts.

- Gather Data: After selecting a security, the next step is to collect relevant data. This includes financial statements, industry reports, economic indicators, and news articles. Reliable sources such as company filings, financial news platforms, and economic databases are essential for accurate information.

- Analyze Financials: This involves performing ratio analysis and forecasting future earnings. Analysts often create financial models that project future performance based on historical data, adjusting for anticipated changes in the business environment.

- Evaluate the Industry and Economic Context: Investors assess how external factors might impact the company. This includes analyzing competition, regulatory changes, and macroeconomic trends that could affect demand for the company’s products or services.

- Make Informed Decisions: After synthesizing all the information, investors can determine whether the stock is overvalued, undervalued, or fairly priced. This assessment guides their investment decisions, whether that means buying, holding, or selling the security.

- The Importance of Fundamental Analysis

- Fundamental analysis is especially valuable for long-term investors who seek to build a portfolio based on sound investment principles rather than short-term market movements. By focusing on the underlying value of securities, investors can identify opportunities that may not be apparent through short-term trading strategies.

- Moreover, fundamental analysis provides a framework for risk management. By understanding a company’s financial health and market dynamics, investors can make more informed decisions that align with their risk tolerance and investment goals.

- In conclusion, fundamental analysis is an essential approach for discerning the true value of a security. It combines financial data, economic indicators, industry conditions, and qualitative assessments to provide a comprehensive view of a company’s potential for growth. As investors navigate the complexities of the financial markets, mastering the principles of fundamental analysis can empower them to make informed decisions that contribute to long-term success.

The Importance of Market News and Economic Indicators

In the fast-paced world of finance and investing, staying informed is paramount. Market news and economic indicators serve as the backbone of informed decision-making, providing critical insights that can shape investment strategies and financial planning. Understanding their importance is essential for anyone looking to navigate the complexities of the financial landscape.

Understanding Market News

Market news encompasses a wide array of information, from stock market updates to international economic developments. This news is crucial for investors as it can influence market sentiment and, consequently, the performance of various assets. For instance, news about corporate earnings, mergers and acquisitions, regulatory changes, or geopolitical events can lead to significant price movements in stocks and commodities.

Staying updated with market news helps investors anticipate trends, manage risks, and seize opportunities. For example, a positive earnings report from a major company can lead to a surge in its stock price, while negative news may prompt a sell-off. By monitoring market news, investors can make timely decisions that align with their financial goals.

The Role of Economic Indicators

Economic indicators are statistics that provide insight into the overall health of the economy. These indicators include metrics such as Gross Domestic Product (GDP), unemployment rates, inflation rates, consumer confidence indices, and more. Each of these indicators offers a different perspective on economic performance and can significantly impact market conditions.

For instance, a rise in unemployment rates may signal economic distress, prompting investors to reassess their portfolios. Conversely, strong GDP growth can indicate a robust economy, encouraging investment in stocks. Understanding these indicators allows investors to gauge the economic environment and make informed predictions about future market movements.

Integrating Market News and Economic Indicators

The true power of market news and economic indicators lies in their integration. Savvy investors analyze how economic data affects market sentiment and vice versa. For example, if a major economic report shows unexpected inflation, market news may reflect investor reactions, leading to volatility in interest rates and stock prices.

By synthesizing information from market news and economic indicators, investors can develop a more comprehensive view of the financial landscape. This holistic approach enables them to make better-informed decisions, whether they are trading stocks, investing in bonds, or exploring alternative assets.

How to Integrate Fundamental Analysis into Your Trading Strategy

In the fast-paced world of trading, it’s easy to get swept away by market trends, technical indicators, and the latest news headlines. However, to achieve long-term success, integrating fundamental analysis into your trading strategy can provide a solid foundation. Fundamental analysis involves evaluating a security’s intrinsic value by analyzing various economic, financial, and other qualitative and quantitative factors. Here’s how you can effectively incorporate this method into your trading approach.

1. Understand Key Economic Indicators

Begin by familiarizing yourself with key economic indicators that can influence market movements. These include Gross Domestic Product (GDP), unemployment rates, inflation data, and interest rates. For instance, a rising GDP often signals a growing economy, which can positively impact stock prices. By staying updated on these indicators, you’ll be better positioned to anticipate market trends and make informed trading decisions.

2. Analyze Company Financials

For stock traders, understanding a company’s financial health is crucial. Start by reviewing financial statements such as the income statement, balance sheet, and statement of cash flows. Key metrics to focus on include Earnings Per Share (EPS), Price-to-Earnings (P/E) ratio, and return on equity (ROE). These figures can help you assess whether a stock is undervalued or overvalued, guiding your entry and exit points.

3. Evaluate Industry Trends

Each industry has its own dynamics and trends that can affect the performance of its companies. Conduct industry analysis to identify which sectors are experiencing growth and which are stagnating. Look for reports, news articles, and expert analyses that can provide insights into emerging trends. By aligning your trades with industries showing strong fundamentals, you can enhance your chances of success.

4. Monitor Market Sentiment

Market sentiment can have a significant impact on price movements, often driven by news events or changes in investor perception. Use tools like sentiment analysis to gauge the mood of the market. This can include monitoring social media, news cycles, and economic forecasts. Understanding market sentiment can help you anticipate potential price swings and refine your trading strategy accordingly.

5. Combine Technical and Fundamental Analysis

While fundamental analysis offers deep insights, combining it with technical analysis can provide a more comprehensive trading strategy. Technical indicators can help identify entry and exit points based on price movements, while fundamental analysis ensures that you are trading based on a solid understanding of value. This integrated approach allows you to benefit from both the underlying economic

Subsection 3.3: Risk Management Strategies

Risk Management Strategies: Safeguarding Your Business Against Uncertainties

In today’s dynamic business environment, effective risk management strategies are essential for organizations aiming to protect their assets and ensure long-term success. These strategies not only help in identifying potential risks but also enable businesses to develop proactive measures to mitigate them. Here are some key risk management strategies that can bolster your organization’s resilience:

1. Risk Assessment and Analysis

The first step in any risk management strategy is to conduct a thorough risk assessment. This involves identifying potential risks that could affect your business operations, whether they are financial, operational, reputational, or regulatory. Once identified, each risk should be analyzed to determine its likelihood and potential impact. Tools such as SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) and risk matrices can help prioritize risks and facilitate informed decision-making.

2. Risk Avoidance

One of the most effective strategies in risk management is risk avoidance, which entails altering plans to sidestep potential risks altogether. This could mean choosing not to engage in certain activities that are deemed too risky or pursuing alternative strategies that reduce exposure. For instance, a company might decide to forgo entering a volatile market or avoid launching a product that has a high potential for failure.

3. Risk Reduction

While it may not be possible to eliminate all risks, organizations can implement measures to reduce their impact or likelihood. This could include enhancing operational procedures, investing in technology, or providing training to employees. For example, implementing strong cybersecurity protocols can significantly reduce the risk of data breaches. Regular maintenance of equipment can also prevent operational disruptions, further minimizing risk.

4. Risk Sharing

Sharing risks can be an effective strategy, especially for large-scale projects. This can be achieved through partnerships, outsourcing, or insurance. By distributing risk among multiple parties, organizations can lessen their burden and protect themselves against significant losses. For instance, businesses often use insurance policies to cover potential losses from unforeseen events, such as natural disasters or liability claims.

5. Risk Retention

In some cases, the cost of mitigating a risk may outweigh the potential loss. In such scenarios, organizations may opt to retain the risk, accepting the possibility of loss as part of their operational strategy. This approach requires careful consideration and a clear understanding of the risks involved. It’s important to have a contingency plan in place to manage the outcomes if the risk materializes.

6. Continuous Monitoring and Review

The business landscape is constantly evolving, and so are the risks associated with it. Therefore, implementing a strategy for continuous monitoring and review of risks is crucial. Regularly reassessing your risk management strategies ensures that they remain effective and relevant. This can involve setting up key risk indicators (KRIs) to track changes in risk levels and conducting periodic audits to evaluate the effectiveness of your risk management processes. By staying vigilant, organizations can quickly adapt to new threats and seize opportunities as they arise.

7. Establishing a Risk Management Culture

A strong risk management culture within an organization can significantly enhance the effectiveness of risk management strategies. This involves fostering an environment where employees at all levels are aware of risks and encouraged to contribute to risk identification and mitigation efforts. Providing training and resources to employees helps cultivate a mindset that prioritizes risk awareness and proactive management. Leadership should exemplify this culture by demonstrating commitment to risk management in their decision-making processes.

8. Utilizing Technology and Data Analytics

Incorporating technology and data analytics into your risk management strategy can provide valuable insights and enhance decision-making. Advanced analytics can help identify patterns and predict potential risks, allowing organizations to take preemptive action. Tools such as risk management software can streamline the risk assessment process, making it easier to track risks and implement controls. Additionally, leveraging big data can uncover hidden risks and trends that might not be immediately apparent.

9. Scenario Planning and Simulation

Scenario planning involves envisioning various future scenarios and their potential impacts on the business. This strategy allows organizations to better prepare for uncertainties by testing their responses to different risk situations. Simulation exercises can be particularly effective in identifying weaknesses in existing plans and improving overall readiness. By exploring “what-if” scenarios, businesses can develop more robust strategies and create contingency plans for unexpected events.

Subsection 3.4: Psychological Strategies

Psychological Strategies in Trading: Mastering the Mind for Market Success

In the fast-paced world of trading, where decisions can make or break your financial future, understanding the psychological aspects of trading is just as crucial as mastering technical analysis or market trends. Psychological strategies go beyond mere numbers on a screen; they delve into the mental and emotional processes that influence decision-making. Here, we explore key psychological strategies that can help traders enhance their performance and maintain a disciplined approach.

1. Emotional Awareness and Regulation

The first step in developing effective psychological strategies is cultivating emotional awareness. Traders often experience a rollercoaster of emotions, from euphoria during winning trades to despair after losses. Recognizing and acknowledging these feelings is vital. Keeping a trading journal can be an invaluable tool for this purpose. By documenting your thoughts and emotions during each trade, you can identify patterns in your behavior and responses to different market conditions. This self-awareness allows for better emotional regulation, helping you avoid impulsive decisions driven by anxiety or excitement.

2. Setting Realistic Goals

One of the most significant psychological hurdles traders face is the pressure to achieve unrealistic returns. Setting achievable, incremental goals can help mitigate this pressure. Instead of aiming for a home run on every trade, focus on consistent, small gains. This strategy fosters a growth mindset, where progress is measured by skill development rather than solely by financial outcomes. Celebrate small victories, and remember that trading is a marathon, not a sprint.

3. Developing a Trading Plan

A well-defined trading plan serves as a roadmap for your trading journey. It outlines your strategy, including entry and exit points, risk management techniques, and criteria for trade selection. By having a plan in place, you reduce the influence of emotional decision-making. Stick to your plan, and resist the temptation to deviate based on fleeting market sentiment or fear of missing out (FOMO). A disciplined approach can help you maintain focus and prevent emotional trading mistakes.

4. Practicing Mindfulness and Stress Management

Mindfulness is a powerful psychological strategy that involves being present in the moment and fully aware of your thoughts and feelings without judgment. Practicing mindfulness can reduce stress and improve your ability to make rational decisions under pressure. Techniques such as meditation, deep breathing exercises, or even short breaks during trading can enhance your focus and clarity. By managing stress effectively, you can approach trading challenges with a calm and composed mindset.

Section 4: Creating Your Own Trading Plan

Creating Your Own Trading Plan

A well-structured trading plan is your blueprint for success in the financial markets. It embodies your trading philosophy, strategies, and risk management techniques. Crafting a personalized trading plan not only helps you stay disciplined but also allows you to navigate the market’s inevitable ups and downs with confidence. Here’s how to create your own trading plan.

1. Define Your Trading Goals

The first step in creating a trading plan is to clearly define your goals. Are you looking to generate a steady income, build long-term wealth, or simply grow your trading skills? Your objectives will influence your trading style, risk tolerance, and the strategies you choose to employ. Be specific about your goals—consider factors like timeframes and expected returns.

2. Assess Your Risk Tolerance

Understanding your risk tolerance is crucial. Different traders have varying levels of comfort when it comes to risk. Assess how much capital you can afford to lose and define your maximum acceptable loss for each trade. This will help you set stop-loss orders and position sizes, ensuring that no single trade can significantly harm your overall portfolio.

3. Choose Your Market and Instruments

Decide which markets and financial instruments you want to trade. Whether it’s stocks, forex, commodities, or cryptocurrencies, each market has its own dynamics and requires tailored strategies. Consider starting with a market you are familiar with, and gradually expand your focus as you gain experience.

4. Develop Your Trading Strategy

Your trading strategy is the core of your trading plan. This includes the criteria for entering and exiting trades, the timeframe you will trade (day trading, swing trading, long-term investing), and the specific indicators or analysis methods you will use. Backtest your strategy on historical data to evaluate its effectiveness and fine-tune your approach based on the results.

5. Establish Risk Management Rules

Risk management is essential for preserving your trading capital. Define rules for position sizing, diversification, and stop-loss levels. A common rule is to risk only a small percentage of your trading capital on each trade—typically 1-2%. This approach helps protect your portfolio from significant losses and allows you to stay in the game longer.

6. Keep a Trading Journal

Documenting your trades and the rationale behind each decision is a vital part of any trading plan. A trading journal allows you to analyze your performance, identify patterns in your trading behavior, and learn from your mistakes. Regularly reviewing your journal

Section 5: Continuous Learning and Adaptation

Continuous Learning and Adaptation: The Cornerstones of Personal and Professional Growth

In a rapidly changing world, the ability to learn continuously and adapt to new circumstances is more vital than ever. The landscape of technology, business, and even our personal lives is in constant flux, driven by innovation, globalization, and shifting societal needs. Embracing a mindset of continuous learning and adaptation is essential for thriving in this environment.

The Importance of Continuous Learning

Continuous learning refers to the ongoing, voluntary, and self-motivated pursuit of knowledge for personal or professional development. It encompasses formal education, informal learning, on-the-job training, and self-directed study. Here are some compelling reasons why continuous learning is crucial:

- Staying Relevant: In industries that evolve rapidly, skills can quickly become obsolete. Engaging in continuous learning helps individuals stay ahead of the curve, ensuring that their skills remain relevant and marketable.

- Enhancing Problem-Solving Skills: Continuous learning encourages critical thinking and fosters creativity. By exposing yourself to new ideas and perspectives, you become better equipped to tackle challenges and find innovative solutions.

- Boosting Confidence: Gaining new knowledge and skills can significantly boost your confidence. Whether you’re mastering a new technology or enhancing your leadership abilities, the more you learn, the more empowered you feel.

- Career Advancement: Employers value individuals who take the initiative to learn and grow. By continuously improving your skill set, you position yourself as a strong candidate for promotions and new opportunities.

- Personal Fulfillment: Learning can be a deeply satisfying endeavor. It enriches your life, broadens your horizons, and fosters a sense of achievement. Whether it’s picking up a new hobby or advancing your career, the pursuit of knowledge can lead to a more fulfilling life.

The Role of Adaptation

While learning equips us with new skills and knowledge, adaptation is the process of adjusting to new conditions. It involves being flexible and open to change, which is crucial in both personal and professional contexts. Here’s why adaptation is key:

- Navigating Change: Change is the only constant in life. The ability to adapt allows individuals and organizations to pivot in response to new challenges and opportunities, ensuring long-term success.

- Fostering Resilience: Adaptation builds resilience. When faced with setbacks or unexpected changes, those who can adapt are more likely to bounce back and thrive rather than become overwhelmed

Conclusion

In conclusion, mastering the art of trading on Binomo requires a blend of knowledge, strategy, and discipline. The five secrets we’ve uncovered in this blog post serve as a robust foundation for both novice and experienced traders looking to enhance their profitability. By understanding market trends, leveraging technical analysis, and maintaining a disciplined approach to risk management, you can significantly improve your trading outcomes.

Remember, the journey to successful trading is not a sprint but a marathon. Continuous learning and adaptation are key to navigating the dynamic world of online investing. As you implement these strategies, remain patient and stay committed to refining your skills. With time and practice, you’ll find yourself on a path to greater financial success.

So, take these insights to heart, develop your unique trading style, and enjoy the process of becoming a more skilled trader. Happy trading